Deadline for filing federal and state taxes expires: USA

INTERNACIONAL

16-10-2023

Web

Publicado: 16-10-2023 15:45:03 PDT

Actualizado: 16-10-2023 15:47:03 PDT

Taxpayers can file them through the website, by phone, or the IRS app at any time. To avoid penalties, it is recommended to make the payment before the specified date

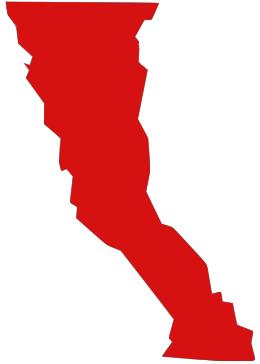

"As a result, the majority of individuals and businesses in California will now have until November 16 to file their 2022 returns and pay any owed taxes. Fifty-five out of 58 California counties, all except Lassen, Modoc, and Shasta counties, qualify. The IRS relief is based on three FEMA disaster declarations covering severe winter storms, floods, landslides, and mudslides over several months," the IRS stated in a press release.

The California Franchise Tax Board promotes the free electronic filing of state tax returns through CalFile and other services on its website.

Payment options:

- Electronic Payment: Taxpayers can make payments when filing electronically using online tax software. Those who use a tax preparer can request the payment to be made through electronic fund withdrawal from a bank account.

- IRS Direct Pay: Taxpayers can pay online directly from their checking or savings account for free, but an IRS online account is required.

- Card Payment: Payments can be made with credit cards, debit cards, or digital wallets.

Failure to file the tax return on time results in IRS penalties, ranging from 5% to 25% of the amount owed, and these penalties are retroactive. It is advisable to visit the IRS website for more information.